The demand for crypto trading in India has grown rapidly, especially as more people look for alternatives outside traditional equity markets. With stricter restrictions on equity derivatives and rising inflation concerns, a wave of traders from both metro cities and smaller towns has started exploring crypto futures and options (F&O).

This isn’t just a passing trend – it reflects a larger shift toward digital assets as tools to generate income, hedge risks, and diversify portfolios.

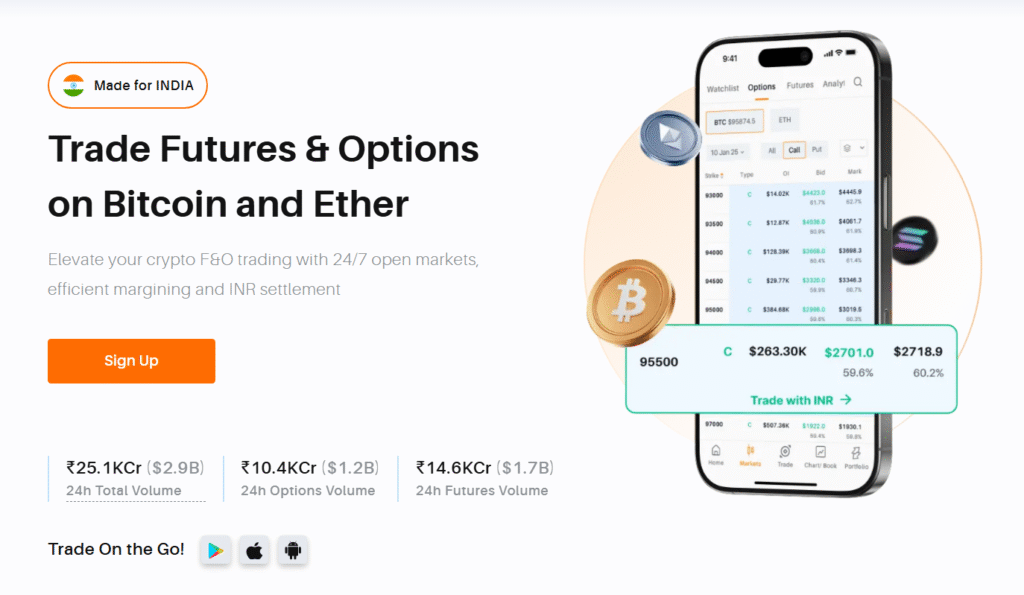

But while the interest is undeniable, most beginners agree on one thing: trading crypto derivatives can be intimidating. Futures, options, leverage, liquidation risks—it can sound overwhelming. That’s where crypto trading platforms like Delta Exchange step in, positioning themselves as platforms tailored to simplify the crypto futures and options experience.

In this article, we’ll address the real question is – does Delta Exchange truly make crypto futures and options trading seamless? Let’s find out.

A Quick Recap on Crypto Futures and Options

Trade crypto options smoothly on Delta Exchange

Here’s a quick overview of what crypto F&O means.

- Crypto futures are contracts where you agree to buy or sell crypto at a predetermined price on a future date. They’re widely used for hedging or speculating on price movements.

- Crypto options give you the right – but not the obligation – to buy or sell crypto at an agreed price. Traders often use them for risk management or directional bets.

Another type of crypto derivatives are trackers. These mimic the price of assets like Bitcoin but without leverage or expiry. Think of them as straightforward instruments for those who want exposure to prices without the complexity of crypto futures and options contracts.

Delta Exchange offers all three – futures, options, and trackers – giving traders the flexibility to choose what suits their style. Whether you want to speculate, hedge, or simply mirror market movements, it brings all crypto derivatives under one roof.

Making Crypto Futures and Options More Accessible

One of the main reasons traders hesitate to explore derivatives is the perceived complexity. Delta Exchange addresses this by creating a trader-friendly environment with features that reduce friction at every step.

INR support for Indian users

For Indian traders, INR deposits and withdrawals make a huge difference. Instead of dealing with crypto wallets or worrying about conversion charges, you can transact directly in Rupees. It trims down unnecessary steps and costs, letting users focus solely on trading.

Automation tools

Delta integrates APIs and algo trading bots, allowing users to run strategies without manually placing and closing every order. For seasoned traders, this opens the door to algorithmic trading. For beginners, it offers the chance to run simple rule-based strategies hands-free.

Flexible risk controls

Trading with high leverage can be profitable but risky. Delta offers up to 100x leverage on futures (200x on some contracts) but balances it with stop-loss and take-profit tools. Trackers, on the other hand, allow you to trade at 1x leverage, giving more conservative traders exposure without the fear of liquidation.

Smooth interface

Whether on the website or mobile app (for both iOS and Android), Delta’s interface is designed to be clutter-free. Contracts, charts, and payoff tools are only a click away, making the experience less intimidating, even for first-time traders.

Risk Management Made Easier

No matter how experienced you are, risk management sits at the heart of sustainable trading. Delta Exchange ensures traders aren’t left in the dark when it comes to potential outcomes.

- Demo account: Users can practice in simulation mode, testing out crypto futures and options strategies with zero capital at risk. This builds familiarity before transitioning to live trading.

- Payoff charts: Every position comes with a clear payoff chart displaying possible profit and loss scenarios. You can see your breakeven levels and risk exposure ahead of time, making decisions more calculated rather than based on guesswork.

This emphasis on educating traders while letting them test strategies helps remove a large part of the uncertainty that often shadows crypto futures and options trading.

Step-by-Step on Getting Started

Follow these simple steps to begin:

- Sign up on Delta Exchange with basic details like email ID.

- Deposit INR using UPI or bank transfer.

- Explore crypto futures and options and plan your trading strategies.

- Set your order using the available tools and confirm the trade.

- Withdraw profits directly back in INR without additional conversion hoops.

This flow removes many of the barriers often seen on global cryptocurrency exchanges that require wallet integrations, crypto deposits first, or hidden transaction charges.

Why Delta Exchange Fits Different Trader Profiles

Delta Exchange: A leading crypto futures and options trading platform

What makes Delta interesting is its adaptability. It isn’t only for advanced traders – nor is it restricted to beginners either.

- For retail and casual traders: Small lot sizes lower the entry barrier. For example, BTC contracts can be started at around ₹5000, while ETH contracts are available at ₹2500. New traders can get started without stretching their capital.

- For high-frequency or professional traders: Liquidity, automation, and leverage options allow larger, more complex strategies to run efficiently.

- For risk-conscious investors: Trackers let you participate in crypto price movements without leverage or liquidation fears.

This inclusivity makes the platform versatile enough for a wide range of users.

Customer Support and Trust

A platform may have all the right features but the experience falls flat if users can’t get help when they need it. Delta Exchange understands this and offers 24/7 customer support through its dashboard-based ticket system. Whether it’s a transaction issue or confusion about a trade, responses are timely and focused on resolving user concerns quickly.

On the trust front, Delta is registered with India’s Financial Intelligence Unit (FIU), which adds credibility, especially in a market where regulatory uncertainty often clouds investor confidence. Compliance with anti-money laundering guidelines ensures users that the exchange is aligned with Indian frameworks.

So, is it Really Hassle-Free?

Looking at the platform holistically – the INR support, automation features, risk control tools, intuitive design, and regulatory compliance – it’s fair to say that Delta Exchange significantly reduces many of the common barriers in crypto futures and options trading.

Of course, crypto futures and options carry inherent risks, especially in volatile markets like crypto. But Delta makes the experience smoother, especially for those testing the waters for the first time. Even experienced traders find value here for the affordability, liquidity, and transparency.

To Sum Up

Crypto derivatives may seem complex, but with the right platform, the process doesn’t have to be intimidating. Delta Exchange proves this by offering a practical balance of features for both new and seasoned traders.

What stands out is how the platform reduces hassle: INR deposits without conversion costs, demo trading for practice, payoff charts for clarity, and bots for automation. Combine that with one of the cleanest interfaces among crypto exchanges, and trading suddenly becomes less of a chore and more of an opportunity.

To start trading crypto futures and options, visit www.delta.exchange or join the community on X for the latest updates.

Disclaimer: Investing in cryptocurrency carries a high risk of market volatility. Kindly do your own research before investing.