Do you want to learn how to build wealth?

When it comes to building wealth, there are several strategies and even more opinions. Some people get lucky, like winning the lottery, inheriting vast sums of money from their long-lost uncle, or being fortunate enough to buy that one in a million stock that explodes in value.

The majority of us aren’t lucky enough to be in the right place at the right time. Instead, for the people who want a happy early retirement, we have to accumulate wealth over the long run using a strategic how to build wealth plan. Banking on getting lucky at some point in your life is a losing endeavor for most, but wealth can be obtainable for those who take the time to understand these three simple steps:

- Make money

- Save money

- Invest money

Execute these three steps properly, and accumulating wealth is not only achievable but likely.

How to Build Wealth Steps

If you can master these three steps, making money, saving money, and investing money you will be on your way to building personal wealth.

Making Money

How one makes money is one of the most difficult and important decisions in a person’s life. To complicate the matter further, this is usually a decision that someone is forced to make when they’re still a teenager and with limited world experience. Someone faced with this decision should consider the time and cost of the education, the earnings potential of that career, and if it’s something that they can see themselves doing for the next 40 years of their life.

Making money is a fundamental step to ensure a fruitful and enriched life. If the career you’ve chosen doesn’t compensate you adequately, many people decide to add side gigs for additional earnings. The good news is, side gigs are usually added later in life when people have more experience and ability to select something they enjoy doing. In some situations, side gigs end up becoming more profitable than the main gig.

Saving Money

It’s important to understand that saving money and investing money are not the same thing. Saving money starts with good spending habits, not buying stuff you don’t need, and making good choices on the money you do spend. Staying away from extremely high margin items, no matter how small those purchases are, is an excellent place to start. Going to the movies once a month and buying $20 worth of snacks that’s only worth $2 can add up dramatically over a lifetime.

Spending large amounts of money on depreciating assets is also a losing strategy. For example, spending $35,000 on a brand-new car versus buying the same two-year-old model for $25,000 will have a dramatic effect on long-term wealth.

Most people don’t understand the long-term time value of the dollar, and by doing so, people end up spending money without putting much thought into it. For example, if a 25-year-old decided to buy a used car versus a new car, and instead saves $10,000 for investing, their long-term wealth would substantially be increased. You might not have the same shiny car your friend has, but you’ll likely retire a decade before them. You need to ask yourself, would you rather drive a shiny new car in your 20s or retire ten years sooner? Don’t think that’s the case… I’ll explain further on.

Investing Money

Investing money is the process of buying assets that are likely to appreciate over time. The value of money is always decreasing, so simply keeping money in the bank is not an intelligent strategy for building long-term wealth.

If a gallon of milk costs $5 today and costs $6 five years from now, that’s a 20% increase in the cost of goods. This means you would have made 20% on your saved capital just to sustain the same standard of living. To gain wealth, you would’ve had to of gained more than 20% on your saved capital, which would put you ahead of the game. Fortunately, this is relatively easy to do.

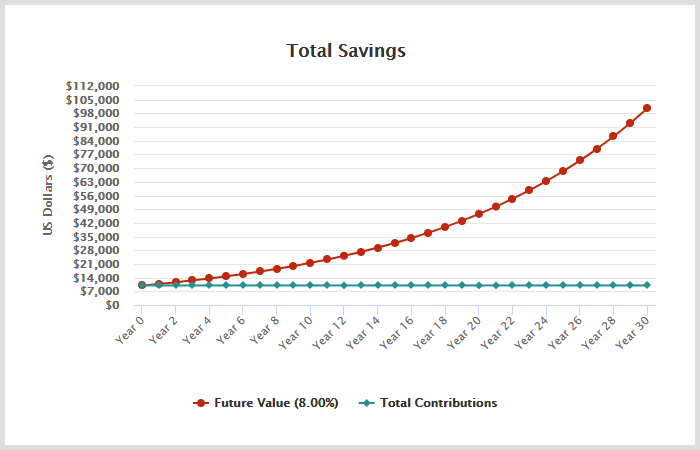

To give you an idea of the power of investing, let’s invest that $10,000 you saved from buying a two-year-old car versus the new car. If you were to invest that money at 8% annually, which would be extremely easy to do based on historical averages, at the end of the year, that $10,000 would now be worth $10,800. That would then compound on itself, and by the end of year two, you would now have $11,664. This keeps going on and on. By the end of five years, your money is now worth $14,693.

For the person that decided to buy a used car at the age of 25 and save that $10,000, investing it intelligently, by the time they were 55 years old, their $10,000 would be worth $100,626! That’s the power being able to make money, then make smart decisions with the money, and then investing it intelligently. Just imagine what it’s like for people who achieve even higher rates of return on their capital.

Getting There

For those who put in the time to learn how to invest properly, much larger returns are obtainable. To put this in perspective, if the same person put their $10,000 to work at an 18% annual interest rate, they would have a payout of $1,433,706 at the end of 30 years. That’s not an exaggeration, and that’s if they never saved anything again! Just imagine if you saved more and implemented a solid investment plan.

Too many people put their retirement, arguably the most valuable asset they have, in the hands of a stranger. People acquire lots of different skills over their lifetime; learning how to invest their own money is definitely a skill that everyone should take the time to learn. The reason being, nobody cares more about your money than you.

Over the long run, no strategy beats investing in the stock market. Many investors fear the stock market due to the volatility. However, investors can’t make the best returns if at least a portion of their savings isn’t in the area where the best returns are achieved. And when you combine stocks with options, not only are investors able to mitigate risk, but even higher levels of performance can be achieved. The smartest investors like Warren Buffett and Peter Lynch achieve great success by combining a stock and options strategy, but anyone can do it.

Take Control of Your How To Build Wealth Plan

For people who want to take control of their wealth and learn options trading for FREE, so that they can put their saved capital to better use, OptionStrategiesInsider.com has you covered. Their options trading strategies teach users how to mitigate risk, diversify an already existing stock portfolio, and make above-average returns using less capital within their portfolio. This ensures smart investors a happy medium between risk and reward, enabling them the ability to achieve their long-term financial goals.

Comments are closed.