LIC has launched 4 new plans in the calendar year 2019 (till date). In this post I have tried to list down the important features, details and my recommendations on all LIC New Plans that are launched in 2019-20.

From January 2018 to till-date (Nov 2019), LIC has launched two Endowment Insurance plans, one offline Term insurance plan and one on-line Term life insurance plan.

Before discussing more on the LIC New Plans list, let us understand more about the different types of Traditional Life Insurance plans.

Types of Traditional Life Insurance plans

What is an Endowment plan? – It is a combination of insurance and investment. The insured will get a lump sum along with bonuses (if any) on policy maturity (or) on death event.

What is an ‘Whole-Life Insurance Plan’? – It is a life insurance policy which is guaranteed to remain in force for the insured’s entire lifetime. The Sum assured is paid to the Policyholder’s nominee in the event the insured dies.

What are Money-back policies? – They provides life coverage during the term of the policy and the maturity benefits are paid in installments by way of Survival Benefits (money-back payments).

What are Limited Premium Payment Insurance Plans? – A limited premium payment plan is a plan where you pay the premium for a shorter span of time and enjoy the benefits of an insurance cover for a long time.

What is a Single Premium Plan? – It is the insurance policy where you pay insurance only in the first year but continue to enjoy the life cover and other plan related benefits throughout the term of the policy.

What is Term Life Insurance Plan? – Term insurance is the simplest and most fundamental insurance product. These insurance plans are designed to ensure that in the event of the policyholder’s death, the family gets the sum assured (the cover amount). Term plan provides risk coverage for a certain period of time (policy term/duration). If the insured dies during the time period specified in the policy and the policy is active – or in force – then a death benefit will be paid. It is the cheapest form of Life insurance in terms of premium.

You may go through my previous Annual Reviews : LIC’s New Plans List 2017-18 & LIC New Plans List 2018-19.

LIC New Plans 2019-2020 | Snapshot

The list of LIC new plans 2019-2020 are namely;

- LIC Micro Bachat Plan

- Nav Jeevan Plan

- LIC Tech Term plan and

- LIC Jeevan Amar Term Insurance plan.

I have listed down the important features of LIC of India’s new plans that are launched in 2019 along with my recommendations (whether to ignore a plan or to buy).

Micro Bachat Plan

- LIC has launched Micro Bachat plan in Feb 2019.

- Micro Bachat is a non-linked, participating, endowment insurance plan.

- The maximum Sum Assured offered under this policy is Rs 2 lakh only.

- The Maturity benefit under this plan is “Sum Assured on Maturity” along with Loyalty Addition (LA), if any, will be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

- The expected returns on this plan can be around 4 to 5%. But do remember that the returns are highly dependent on the LA rates.

- For more details on this plan, you may kindly visit this link – LIC Micro Bachat Plan Review.

LIC Nav Jeevan Plan

- Nav Jeevan plan was launched in March 2019. This plan is currently not open for subscription.

- Nav Jeevan plan is a non linked, with profit, Endowment Life Assurance plan. The main feature of this plan is that the policyholder has the option to choose between two premium payment options i.e., single premium (or) limited premium payment term of 5 years. .

- The minimum Sum Assured offered under this policy is Rs 1 lakh.

- The Maturity benefit under this plan is “Sum Assured on Maturity” along with Loyalty Addition (LA), if any, will be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

- The expected returns on this plan can be around 6%. But do remember that the returns are highly dependent on the LA rates.

- For a detailed review of this insurance plan, you may kindly visit this link – Nav Jeevan Plan|Features & Review.

LIC Jeevan Amar Term plan

- LIC has launched its new offline Term insurance plan called Jeevan Amar in August 2019.

- The minimum Sum Assured offered under this policy is Rs 25 lakh.

- The Maturity benefit under this plan is Nil.

- In case, the policy holder expires anytime during the policy tenure, his/her nominee will receive the death benefit as a lump sum amount and the policy gets closed.

- For a detailed review of this insurance plan, you may go through this link : LIC Jeevan Amar Plan : New Offline Term Life Insurance Plan | Details & Review

LIC Tech Term Plan

- LIC has launched its new online Term life insurance plan called ‘Tech Term’ in September 2019.

- The minimum Sum Assured offered under this policy is Rs 50 lakh.

- The Maturity benefit under this plan is Nil.

- In case, the policy holder expires anytime during the policy tenure, his/her nominee will receive the death benefit as a lump sum amount and the policy gets closed.

- For a detailed review of this insurance plan, you may go through this link : LIC Tech Term Plan : New Online Term Life Insurance Plan | Details & Review

My standard suggestions

- Returns : Are you investing in a life insurance plan with an aim to get investment returns? – The traditional life insurance plans can offer returns in the range of 4 to 7%. Personally, I believe that this is a very low return on investment, considering the fact that one has to remain invested for 10+ years. So, unless you are content with low/stable returns and also have an adequate life cover, the conventional insurance plans may not be for you. (Read : ‘Traditional life insurance plan – a terrible investment option?‘)

- Life insurance cover : Are you buying a life insurance plan for insurance cover? – The main point to note here is, ‘quantum of life cover’. These kind of plans are very costly to get high sum assured. So, if your requirement is to get adequate life cover, affordable Term insurance plans are the right choice. So, you can surely consider buying plans like LIC Tech Term plan.

- Tax Saving : Are you investing in these kind of plans for tax saving under section 80c? – if that’s the case, even a long term Small Savings Scheme like PPF (Public Provident Fund) can be a better choice than a traditional life insurance plan. (Read: ‘PPF + Term plan Vs Traditional life insurance plan‘). You can also consider investing in ELSS tax saving mutual funds for long-term goals.

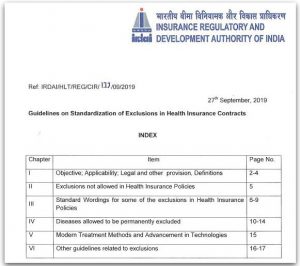

Kindly note that IRDA has recently come up with new set of guidelines for Life insurance plans with respect to Sum assured Vs premium rate, surrender value, revival period etc.,

To meet these new guidelines, LIC is planning to withdraw / discontinue some of its popular plans like Jeevan Anand, Jeevan Umang, Jeevan Lakshya, Jeevan Labh etc., by 1st Dec, 2019.

LIC may re-launch these plans in line with IRDA’s revised guidelines. (The existing polices will not be affected by the changes.)

Generally, December to March is the peak season for the life insurance companies in India. Most of the life insurance plans are offered as ‘tax-saving cum investment’ schemes. So, kindly be aware of the pros & cons of the financial products before you invest.

Continue reading :

(Post first published on : 5-Nov-2019)

Comments are closed.